Long-term holders weather brief volatility surge

[ad_1]

Key Takeaways

- Lengthy-term holders now maintain 75% of the entire circulating provide of Bitcoin

- The cohort has been rising steadily over the past eighteen months

- Fanatics hope the expansion within the variety of cash hoarded by long-term holders will trigger a provide scarcity and squeeze the value upward within the long-term

The final eighteen months have been difficult for Bitcoin buyers. Whereas the asset has bounced again strongly so far in 2023, it stays over 60% off its all-time excessive set in November 2021.

The dimensions of the injury in 2022 may be seen when glancing at a value chart, portraying the extent of the autumn.

The asset careened downwards because the Federal Reserve transitioned to a good financial coverage strategy in response to spiralling inflation. From years of low rates of interest, hikes got here thick and quick as policymakers scrambled to get a lid on an overheating economic system.

With Bitcoin residing to date out on the danger curve, capital fled the asset amid the good tightening of world liquidity. Nevertheless, whereas value charts don’t make fairly studying, there was one notable vibrant spot when on-chain knowledge.

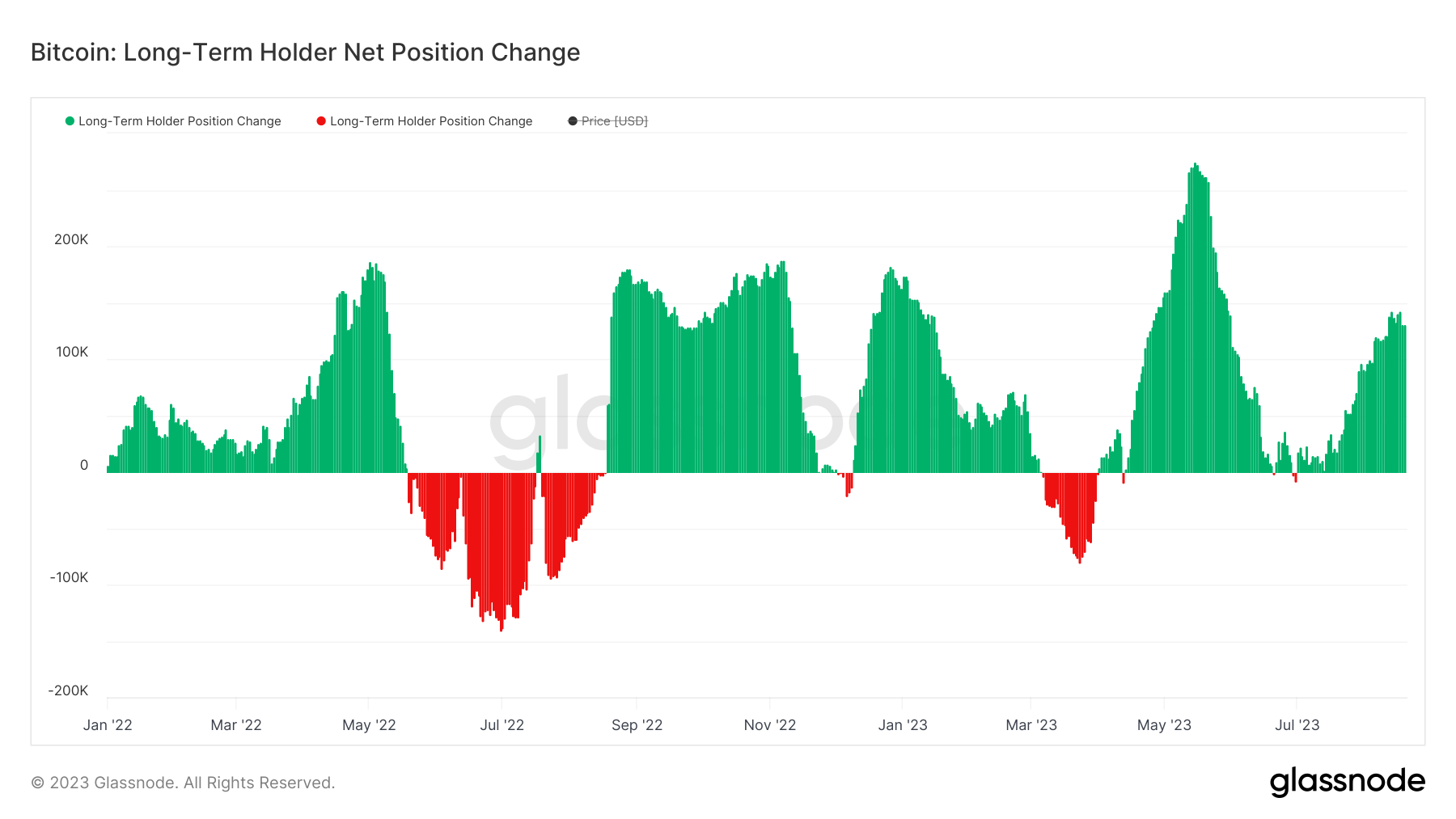

That’s the proportion of long-term holders, which has proven spectacular progress all through the turbulence. As the subsequent chart from Glassnode exhibits, the cohort has grown for the reason that begin of 2022 except for three durations (with a kind of extraordinarily quick).

(As a observe, Glassnode defines lengthy and short-term holders through a logistic perform centered at an age of 155 days and a transition width of 10 days).

(As a observe, Glassnode defines lengthy and short-term holders through a logistic perform centered at an age of 155 days and a transition width of 10 days).

The primary interval was between Might and August 2022, when the crypto world was thrown into disarray. Already preventing a glum macro image with newly-rising charges and rampant inflation, digital belongings acquired hammered additional with the startling dying spiral of the UST stablecoin, resulting in the collapse of all issues Terra. This in flip sparked contagion throughout the sector, the summer season full of bankruptcies.

The second interval which noticed long-term holders waver was very transient, following the FTX collapse final November. The third was then March of this 12 months, which noticed obvious profit-taking as Bitcoin elevated off the again of extra dovish forecasts across the future path of rate of interest rises following the regional financial institution disaster.

This has led to a place at present whereby 14.6 million Bitcoin are held by long-term holders, equal to 75% of the entire circulating provide.

The portion of the availability claimed by long-term holders is attention-grabbing to trace as it’s an oft-referenced level by Bitcoin fanatics when forecasting the long-term value of the asset. With the general provide capped at 21 million cash and the speed of improve in provide halving each fours years, they argue {that a} supply-side squeeze will push the value of Bitcoin up. As long-term holders hoard better quantities of the availability, there’ll solely be much less Bitcoin to go round.

Clearly, the demand facet of the equation wants to carry up its finish of the cut price for this to be true. However amid a particularly difficult eighteen months for Bitcoin, the obvious resilience of long-term holders is definitely a silver lining, and should turn out to be increasingly related as time goes on.

[ad_2]

Source link