Bitcoin volatility at three-year low as crypto markets lull

[ad_1]

Key Takeaways

- Crypto volatility has been dropping all 12 months, with Bitcoin’s volatility now at three-year lows

- Quantity can be dropping, because the calm markets usually are not welcomed by merchants

- Regardless of downward-trending volatility, crypto stays extremely risky when in comparison with different asset courses

Crypto markets are identified for violent volatility, able to each spiking and collapsing within the blink of a watch.

To date this 12 months, nonetheless, that hasn’t been the case. Volatility has been trickling steadily downward throughout the house. Assessing the realised volatility of Bitcoin over a rolling one-month window, the metric is presently at a three-year low.

This comes regardless of Bitcoin having had a bumper 12 months to this point, the asset presently up 76%, treading water across the $30,000 mark. Previously, Bitcoin has oscillated wildly, however this run-up from the low of $15,500 late final 12 months has been distinguished by a gradual climb reasonably than the turbulent ups and downs we now have come to anticipate.

The sample isn’t distinctive to the world’s greatest crypto, both – volatility is falling throughout the board. The simple approach to illustrate that is by Ether. Traditionally, the worth of ETH has been extra risky than BTC, however the divergence has narrowed this 12 months, and Ether is now buying and selling with related volatility to its huge brother.

This relative calm in crypto markets is nice on one degree, given one in all Bitcoin’s most-cited criticisms is its excessive volatility, which most agree it might want to overcome ought to it ever take the standing of a good retailer of worth.

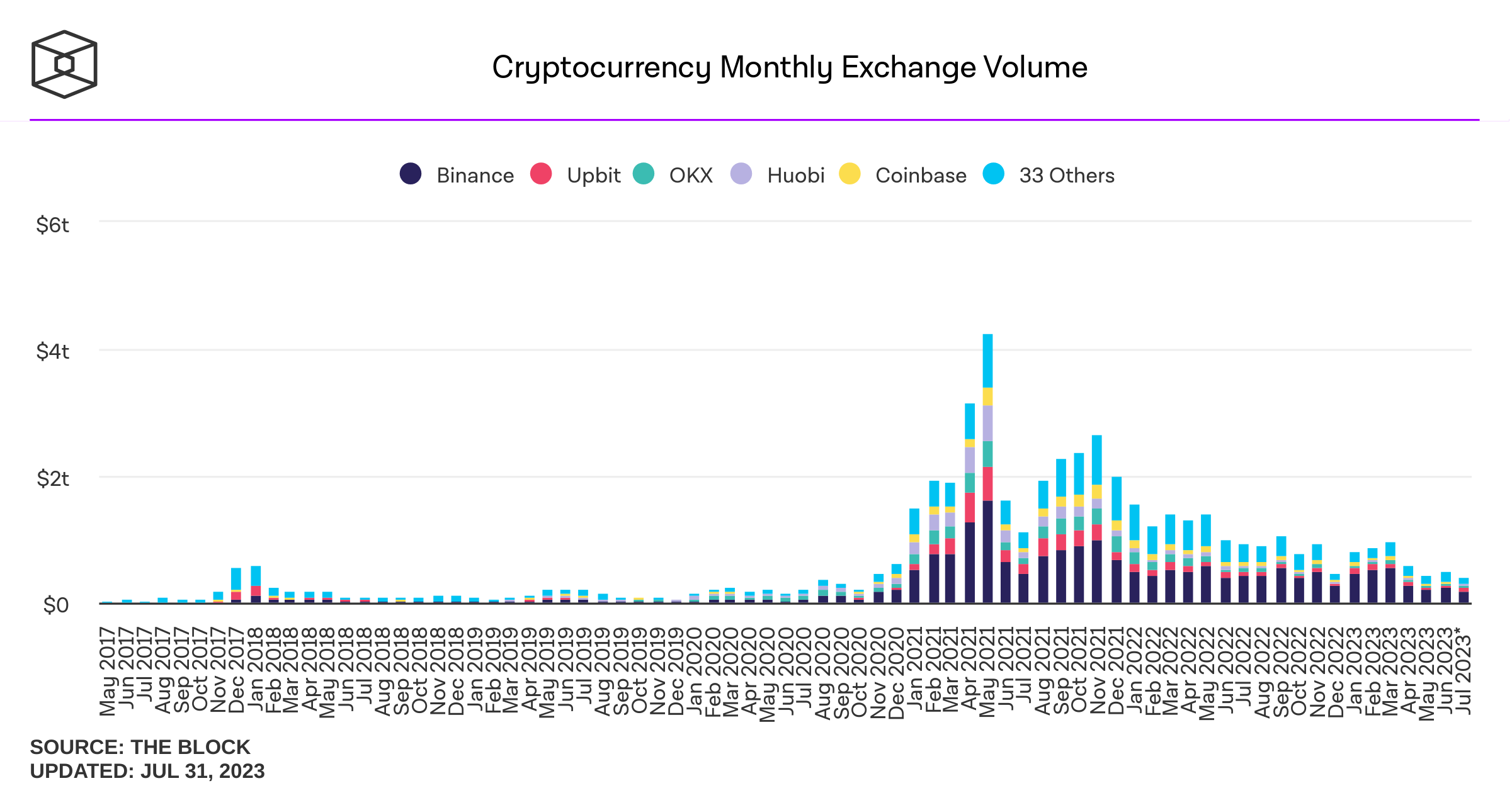

Not everyone seems to be a winner, although. Merchants depend on volatility and therefore these serene occasions usually are not precisely a boon. If we take a look at spot buying and selling quantity, the drawdown has been steep. Granted, there are myriad components at play right here, together with regulation, a drawdown in costs, lockdowns ending, scandals (FTX and the SEC lawsuits) and so forth, however the lack of volatility isn’t serving to.

The beneath chart from The Block reveals fairly how far spot quantity has fallen.

Even derivatives buying and selling quantity, which had been extra stout, has fallen off since April – probably a greater gauge for merchants than assessing spot quantity. Liquidity isn’t as a lot of a priority in derivatives markets because it has turn out to be in spot markets, however the previous few months have begun to see some thinning on the market, too.

Whereas the falling volatility is notable, it needs to be famous that crypto stays a league above trad-fi markets with regard to this metric. Even this three-year low nonetheless interprets to an annualised volatility of 25% for Bitcoin, which might not be deemed low-risk by any stretch of the creativeness.

To place this up in lights, evaluating Bitcoin to gold is at all times illustrative. Gold is the shop of worth which has been round for 1000’s of years, the shiny steel identified for its inflation-hedging skills and lack of correlation to danger property. For a lot of, Bitcoin’s imaginative and prescient is to assert the title of some kind of digital gold.

The beneath chart shows the present gulf between these property – even after the dampening down in crypto volatility this 12 months, it’s on a totally completely different planet to gold.

Alternatively, one can merely examine the every day returns of the property, which conveys the identical factor.

Thus, whereas crypto volatility is presently sluggish, it has an extended approach to go earlier than it matches gold. Extra importantly, there isn’t any assure that this volatility will keep low. Fairly the other – given the low liquidity within the house, much less capital is required to maneuver crypto markets than has been the case beforehand.

In gentle of this, it feels just like the downward development in volatility (exacerbated within the final couple of months by a traditional summer season lull in buying and selling) ought to return. To not point out the truth that with the rate of interest mountain climbing cycle coming to a detailed, markets could possibly be at an inflection level. It’s at all times arduous to foretell the longer term in crypto, however it feels unlikely that digital property’ volatility will keep at these uncharacteristically low ranges for lengthy.

[ad_2]

Source link